Automation and efficiency improvement: DGA-GPT can be used to automate repetitive tasks and processes to improve

production efficiency and work efficiency. Through applications such as automated production lines and

intelligent warehouse management systems, companies can save costs and improve production speed and quality.

Data analysis and prediction: DGA-GPT can help companies analyze massive amounts of data, discover hidden

patterns and trends, and provide data support for decision-making. Through machine learning and data mining

technology, companies can conduct market analysis, predict customer behavior, and optimize product design and

marketing strategies.

Innovative products and services: The development of DGA-GPT provides new possibilities for corporate

innovation. Through artificial intelligence technology, companies can develop smart products and services, such

as smart homes, smart medical equipment, etc., to meet consumers' needs for intelligence and personalization.

Risk management and security assurance: DGA-GPT can be used to identify and prevent various risks and security

threats. Through machine learning algorithms and pattern recognition technology, enterprises can promptly detect

and respond to potential security vulnerabilities and risks, and protect the security of enterprise data and

assets.

DGA-GPT execution strategy: With the help of modern statistics and mathematical logic-based trading investment

models, trading instructions are issued through quantitative methods and computer programs to achieve stable

returns. By screening and formulating precise trading strategies from huge historical data, each fund can

achieve the expected return indicators and achieve continuous, stable and above-average returns.

The many drawbacks of manual trading have gradually become obstacles to profitability, while the accuracy and

100% execution rate of quantitative trading are the obvious benefits that quantitative trading brings to

profitability.

With the advent of the artificial intelligence era and the rapid development of the Internet, the new concept of

AI quantitative trading is spreading faster around the world, and new breakthroughs in the field of intelligent

technology have also played an important role in promoting the development of quantitative trading.

In terms of technical framework, DGA-GPT uses aggregated user idle algorithms to enhance data processing and

analysis capabilities. DGA-GPT adopts a distributed computing framework and uses advanced containerization

technology and cloud-native architecture for task decomposition and distribution. It builds a highly scalable

and flexible arithmetic network based on open source distributed computing platforms such as Kubernetes and

Apache Spark. It also uses containerization technology on top of Kubernetes to achieve task isolation and

deployment. Each task is packaged into a separate container, which contains the required algorithms, data, and

dependencies. This ensures the independence and flexibility of tasks running in different environments and makes

full use of distributed computing resources. By utilizing the computing resources of idle arithmetic, DGA-GPT is

able to handle complex data operations and algorithm calculations more efficiently.

In terms of data processing, DGA-GPT uses big data processing tools such as Apache Hadoop and Apache Spark to

efficiently process and analyze data through the aggregation user idle algorithm, thereby enhancing data

processing and analysis capabilities.

In terms of data synchronization and communication, DGA-GPT uses a data synchronization and communication

mechanism. When a task needs to process a large amount of data, the system will distribute the data to each node

in the cluster and perform synchronization operations to ensure data consistency. At the same time, the nodes

also communicate with each other to share task status and results, thereby realizing the collaborative work of

distributed computing.

In terms of elastic expansion and load balancing, DGA-GPT has the ability to elastically expand and load balance

as user participation and tasks increase. The system can dynamically adjust the size of the device cluster

according to actual needs and automatically balance the distribution of tasks according to the load of the nodes

to achieve optimal resource utilization and efficient execution of tasks.

In terms of human-computer interaction, DGA-GPT provides API and SDK and integrates them into the APP so that

users can easily access the platform and call corresponding functions and services. Through API and SDK, users

can submit tasks, query task status, obtain results, etc., to achieve efficient communication and interaction

with the platform.

In terms of storage and computing, DGA-GPT assembles users' idle devices into distributed device clusters,

connects idle user computing power to the cluster as client software, and uses its storage space as one of the

storage nodes to participate in storage processing tasks, while DGA-GPT's cloud server acts as a server. Using

distributed storage systems such as Hadoop Distributed File System (HDFS) and Ceph, data can be divided into

multiple blocks and distributed in a cluster composed of idle computing power devices for parallel processing.

By utilizing the computing resources of idle arithmetic, DGA-GPT is able to process complex data operations and

algorithm calculations more efficiently, providing data redundancy and high-throughput storage to improve data

reliability and access speed. In this way, DGA-GPT utilizes the storage resources of idle computing power

devices to improve the overall capacity and performance of the storage system. At the same time, this cluster

architecture realizes the transformation of idle devices into valuable computing power resources, providing

users with a way to transform idle computing power into valuable resources, enabling them to participate in the

DGPT ecosystem and provide more training and reasoning for AI tasks. More computing power to support the

benefits of shared storage services.

The Quantitative Income Platform is a proprietary model of artificial intelligence financial solution

capabilities based on the DGA-GPT model. By expanding the capabilities of DGA-GPT in the financial field, the

platform is able to better handle financial data and tasks and perform well in financial benchmarks. We have a

large number of financial data sources and have built a dataset with 363 billion labels to support various

financial tasks. The Quantitative Income Platform is built on the DGA-GPT platform and uses AI financial models

to analyze market sentiment factors, capital flows, and spread data, arbitrage between major platforms, and earn

spread income.

We combine the most advanced DGA-GPT algorithmic capabilities with the perception of macro changes in the market

to maximize returns. We continuously update the optimal return algorithm in real time and perform high-frequency

arbitrage on different trading channels. Users can enter the quantitative finance platform and choose the

appropriate target for compound interest. When you inject funds into the platform, the quantitative finance

model will automatically allocate your funds for investment arbitrage.

As an innovative means, blockchain has opened up new possibilities for various applications by decentralizing

the power, technology, capital, and decision-making aspects of modern business. Among the many blockchain

applications, tokenization is one of the most common and widely used methods.

Tokenization has enabled mass adoption of blockchain technology, providing users with an incentive to

participate in new protocols. Earning models have become the fastest way to attract users, such as Move-to-Earn

startup STEPN, which has attracted more than 5 million users, and Play-to-Earn game Axie Infinity, which has

accumulated 30 million users.

However, existing earning tokenization startups have a major problem, which is unsustainability and unlimited

token inflation. This is because the user inflow rate inevitably declines and new capital stops entering the

economy. The only way to solve the unlimited "earning" inflation problem is to have a strong revenue base to

support paying users.

With DGA-GPT, we combine the commercial application of artificial intelligence with a provable tokenization

mechanism. Unlike other blockchain-based artificial intelligence projects, DGA-GPT aims to make transactions in

the market intelligent. This opens up an untapped market opportunity: entering the market through arithmetic

applications. DGA-GPT's innovative model combines blockchain technology with artificial intelligence to provide

users with continuous income opportunities and drive sustainable economic growth.

Through DGA-GPT, users can participate in the AI training process and obtain continuous benefits by

participating in the platform. At the same time, DGA-GPT's blockchain technology ensures the security and

transparency of transactions, providing users with reliable opportunities to make money. This makes DGA-GPT an

innovative and sustainable income ecosystem for users.

Introduction:

Cryptocurrencies have taken the financial world by storm, providing unprecedented opportunities for investors

and traders. One interesting aspect of the cryptocurrency market is that there are price differences between

various cryptocurrency exchanges, which can be exploited to generate profits through a strategy called

arbitrage. In this blog post, we will dive into the concept of arbitrage, explore why digital assets can trade

at different prices, and introduce you to the DGA-GPT4 smart trading robot - a tool designed to help you seize

these arbitrage opportunities. Artificial Intelligence Tool.

Understanding Arbitrage:

Arbitrage is a strategy that exploits price differences for the same asset across different markets. In the

cryptocurrency space, the concept is particularly attractive because digital asset prices can vary widely

between exchanges. These variations provide traders and investors with opportunities to profit by buying low on

one exchange and selling high on another.

Why are there price differences?

You may be wondering how a single digital asset can trade at two different

prices at the same time. The answer lies in market dynamics, which can lead to price differences due to several

factors:

Market volatility: Cryptocurrency prices are known to fluctuate wildly. Minor fluctuations can cause price

differences between exchanges.

Exchange Fees:

Each cryptocurrency exchange charges its own set of fees, including trading and withdrawal fees.

These costs can affect the final price of an asset. Volume and Liquidity: Liquidity levels vary across

exchanges. Low liquidity can lead to larger price gaps, as a single large trade can significantly affect prices

on smaller exchanges. Geographical Factors: Different regions can have different demand and supply dynamics,

further leading to price differences.

Arbitrage Opportunities:

These price differences between exchanges create arbitrage opportunities. Traders can profit from these

differences by executing a buy order on the exchange with the lower price and a sell order on the exchange with

the higher price, pocketing the spread.

DGA-GPT4 Intelligent Quantitative Robot Introduction:

To take advantage of cryptocurrency arbitrage opportunities, you need an efficient and reliable tool. This is

where the DGA-GPT4 intelligent trading robot comes into play. This AI-driven software was developed by DGA

Investment Co., Ltd. in the UK in collaboration with the OpenAI technology team to help users take full

advantage of these arbitrage opportunities.

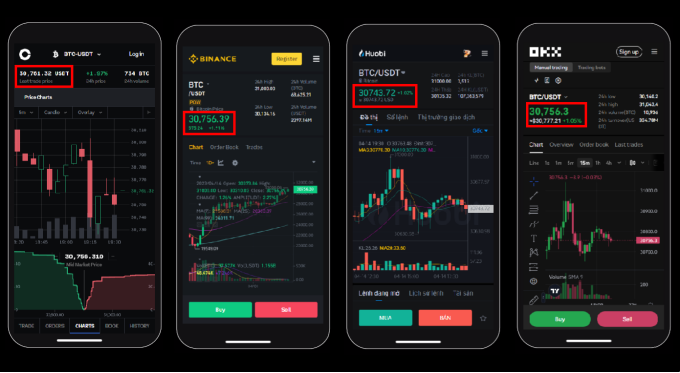

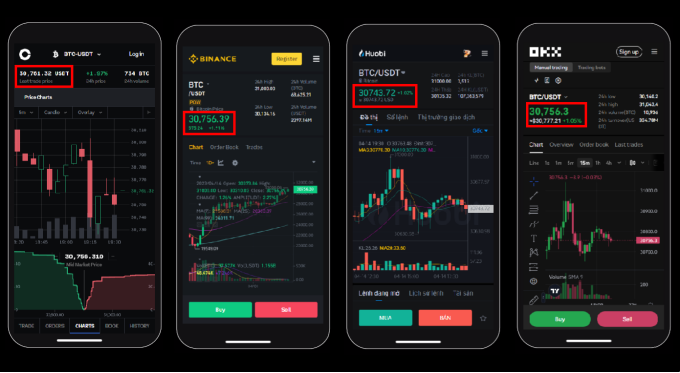

DGA-GPT4 can complete the purchase of Bitcoin at a low price from exchange A and sell it at a high price on

exchange B within 250 milliseconds, making a profit.

For example: (BTC/USDT) is bought at a price of 30743.32 USDT on Binance exchange, and sold at a price of

30761.32 USDT on Coinbase exchange, so that 18 USDT can be earned in one transaction. Note: It is impossible for

humans to buy at the lowest price and sell at the high price almost at the same time within 250 milliseconds.

DGA-GPT4 is a one-stop intelligent trading platform. Let's talk about its advantages.

1. DGA-GPT4’s speed and accuracy

Speed and accuracy play a decisive role in trading results. In a fast-paced, volatile market, a few seconds of

difference can have a profound impact on the results. Manual trading has limited operating speed, and once the

DGA-GPT4 system detects a cryptocurrency that meets the trading criteria, it automatically places an order (buy

low and sell high) in a very short time. Based on pre-written code and algorithms, it executes instructions,

including profit targets and stop losses, at a speed and accuracy that is difficult for anyone to match.

Instructions are executed immediately without delay, which may increase losses if executed manually. DGA-GPT4

has various indicators that are continuously quantitatively analyzed by algorithms 7*24 to ensure that investors

get the best results.

2. DGA-GPT4 is not affected by human emotions

Being carried away and losing one's soul is a mental journey that most traders have experienced. DGA-GPT4

guarantees specific trading results through computer programs and written algorithms, and the process is

automated. DGA-GPT4 is not affected by human emotions and human errors. It can control emotions and prevent

over-trading, thereby avoiding common risks for investors. 3. DGA-GPT4 has super backtesting capabilities

DGA-GPT4 uses historical market and transaction data to intelligently customize intelligent trading models

(multiple models), and selects the model that suits the current market performance for trading and profitability

at the first time. It can continuously iterate the algorithm to achieve maximum profitability.

4. DGA-GPT4’s strict discipline

There is one reason why traders suffer frequent and significant losses, and that is lack of discipline. Lack of

discipline may be caused by fear of loss or the desire to increase profits. DGA-GPT4 can replace investors and

traders to stick to the established trading plan in a volatile market. It can also avoid human operational

errors. For example: when you want to trade 100USDT, you will not mistakenly write 1000USDT.

5. DGA-GPT4 grasps market trends

DGA-GPT4 can analyze the market prospects of large groups and different categories of cryptocurrencies in real

time, and control market transaction nodes through a grading system.

6. DGA-GPT4 Automates Trading Diversification

With DGA-GPT4, N trading strategies can be employed to diversify risk across multiple exchanges and multiple

trade types. Doing this manually can be time-consuming, tedious, inaccurate, and risky. DGA-GPT4 provides

investors with the ability to diversify their trades across multiple trading systems while creating hedges for

losing positions. It helps investors achieve stability in their trading positions.

Compared with manually managing transactions, DGA-GPT4 intelligently and quickly handles a wider range of

portfolios at a lower cost. It can change as the market changes to maximize profitability.

DGA-GPT4 has now undergone its fourth transformation to expand its functions and simplify investors'

transactions. It only takes one click to click the intelligent transaction and wait for 2-3 minutes to achieve

profitability. It is undoubtedly the future of investors.

Different versions, different benefits:

The DGA-GPT4 bot has multiple versions, each with unique benefits. The higher the version number, the greater

the potential daily earnings. Here is the breakdown for a $10,000 investment:

Version 4.0.1: Earns $250 per day, usable for 365 days.

Version 4.0.5: Earns $300 per day, usable for 365 days.

Version 4.1.0: Generates $400 per day, usable for 365 days.

Stay tuned for version 4.1.5: Excitingly, version 4.1.5 is coming soon, promising more efficient arbitrage

capabilities. Keep an eye out for

updates, as this version offers even greater profit potential.

In summary:

Cryptocurrency arbitrage offers lucrative opportunities to profit from price differences across various

exchanges. With the DGA-GPT4 smart trading robot, you can harness the power of AI to maximize your profits.

Whether you are an experienced trader or a novice in the cryptocurrency market, this tool can be your key to

consistent daily profitability. So why wait? Explore the world of arbitrage and let artificial intelligence help

you unlock your financial potential in the exciting world of cryptocurrency.

Company name: Digital Genius Alliance. (DGA Corporation Inc.)

Platform name: DGA-GPT decentralized intelligent trading platform

company background

DigitalGeniusAlliance (DGA) is an artificial intelligence research laboratory and company founded in 2023 and

headquartered in London, UK. The company's mission is to promote the development of artificial intelligence and

ensure its positive impact on human interests. DGA's research focuses on areas such as reinforcement learning,

deep learning, and big data cloud computing processing, aiming to develop artificial intelligence technologies

with broad application prospects. With rich industry experience and leading technology, the company has become a

pioneer and leader in the field of enterprise-level artificial intelligence. DGA focuses on providing

platform-centric full-stack artificial intelligence solutions.

Among them, the DGA-GPT platform is one of the company's decentralized intelligent trading platforms, dedicated

to improving the accuracy, timeliness and maximizing returns of virtual currency market investments. Through the

carefully designed distributed architecture and algorithms, we have successfully achieved the decentralization

of computing power, effectively reducing the risks brought by centralization, while improving the stability and

reliability of the system. This unique design makes the DGPT platform the leading decentralized arithmetic

income platform on the market.

DGA's decentralized computing products and services are now widely used in finance, retail, manufacturing,

energy and power, telecommunications, and healthcare. With the company's Transformer training and comprehensive

DGA-GPT series, as well as its leading position in AI computing solution delivery capabilities, it has

successfully led industry trends and guided and promoted the growth of the entire enterprise AI computing

capability field.

In this trend, DGA not only has a complete range of AI computing products and leading Transformer training

technology, but also has accumulated rich experience and technology in software and hardware integration, big

data processing, deep learning, etc. Our full-stack AI computing solutions, from chips, boards, complete

machines to platform software, are all built on these technologies and experiences.

Partner

DGA has an extensive global partner network, including industry-leading companies such as Microsoft, Apple,

Facebook, Goldman Sachs, Morgan Stanley, American Express, McKinsey, Google, NVIDIA, and Amazon. NVIDIA, Alibaba

Cloud, Tencent, and Amazon. These partners play a key role in the entire industry chain from technology

development to marketing, and work with DGA companies to advance enterprise artificial intelligence technology.

These partners are not limited to hardware manufacturers and service providers, but also include R&D

collaboration, resource sharing, market expansion and other fields. Here are some of our partners:

1. Google: As the world's leading search engine and cloud service provider, Google and XX Technology have

in-depth cooperation in the fields of cloud computing and artificial intelligence, jointly developing and

promoting a series of efficient and innovative artificial intelligence solutions.

2. Nvidia: As one of the world's largest graphics processor (GPU) manufacturers, Nvidia provides

high-performance hardware to DGPT Corporation Inc., enabling us to provide excellent AI computing services.

3. Amazon: As one of the world's largest e-commerce platforms and cloud service providers, Amazon and DGPT

Corporation Inc. have extensive cooperation in artificial intelligence and cloud computing.

4. Microsoft: Microsoft is a world-renowned technology company. We have in-depth cooperation with Microsoft in

many fields such as cloud services, artificial intelligence technology, and enterprise solutions.

5. Apple: As one of the world's largest technology companies, Apple has a wide range of influence in consumer

electronics, software and cloud services. DGPT Corporation Inc. cooperates with Apple in many fields to promote

technological progress.

6. Facebook: Facebook is the world's largest social networking platform. We share data and resources with

Facebook to explore the application of AI technology in social networks.

7. Goldman Sachs: Goldman Sachs is one of the world's largest investment banks. We have in-depth cooperation

with Goldman Sachs in financial artificial intelligence, big data analysis and other fields.

8. Morgan Stanley: Morgan Stanley is a world-renowned financial services company. We have cooperated extensively

with the company in areas such as financial technology and smart investment.

9. American Express: American Express is one of the world's largest payment and credit card companies. We work

closely with American Express in areas such as AI-driven payment technology and smart risk control.

10. McKinsey: McKinsey is the world's most well-known consulting firm. We are working with McKinsey to explore

how to apply AI technology to corporate consulting and decision analysis.

Natural Endowment

DGA has always strictly complied with industry and regulatory standards and obtained a number of certifications

and qualifications in the industry:

1. ISO 27001: This is an international standard that specifies the requirements for information security

management systems, reflecting the high priority and professional management of information security.

2. ISO

9001: This is an international standard that defines the requirements for quality management systems and

demonstrates our continuous pursuit of product and service quality.

3. AI Safety Certification: This is a

specialized certification for AI products and services, indicating that our products and services follow the

highest standards of AI ethics and safety.

product and service

Decentralized computing power leasing platform

DGA is committed to developing more new technologies and products to meet the rapidly changing market needs. The

company has a professional R&D team, upholds the spirit of innovation, and is committed to promoting the

development of AI technology to meet the needs of future intelligent transformation of enterprises. At the same

time, DGA also pays attention to corporate social responsibility, actively participates in various public

welfare activities, and gives back to the society.

About DGA's Future Outlook

The world will gradually enter the era of mobile terminals and digital economy. The number of cryptocurrency

holders continues to grow every year, and the market size will exceed one trillion US dollars. Cryptocurrency

will gradually occupy the position of paper money and have greater commercial value. DGA hopes that through more

people's use and training of DGA-GPT, cryptocurrency market transactions will become more intelligent and the

market environment will be better, just as our motto: change yourself, change the world. In the future, DGA will

move to a higher stage with the expansion of the global cryptocurrency market and continue to create greater

achievements.

The concept of DGA is to combine the potential of artificial intelligence with tangible economic benefits,

providing individuals and organizations with the opportunity to earn income by participating in artificial

intelligence projects and utilizing unused computing power. This approach creates a wider range of economic

opportunities and promotes the advancement and innovation of artificial intelligence technology.

DGA is committed to building a mutually beneficial and win-win AI money-making ecosystem, creating economic

opportunities and development space for participants, and promoting the widespread application of AI technology.

This will bring more economic returns to individual users and organizations, and promote innovation and progress

in the entire industry.

As a decentralized computing platform designed for the AI revolution, the DGA-GPT ecosystem will use

arithmetic as an emerging asset class to contribute to the trillion-level AI economy.

Chapter 1 Overview of Market Development

1.1 Digital currencies drive the digital economy boom

Blockchain, digital currency and innovation represented by the digital economy are global, and this

transformation that integrates technology, industry and financial industry has formed an irreversible situation.

The value of blockchain to build a trusted data sharing environment has been recognized by many parties, and the

demand for various institutions to use blockchain for trusted storage has gradually emerged.

Satoshi Nakamoto published the article "Bitcoin: A Peer to Peer Electronic Cash System" in 2008, which put

forward the concept of bitcoin and blockchain technology for the first time, and built the technical basis for

the secret transmission of transaction information and the bitcoin network through the blockchain technology. In

just a few years, bitcoin has become a legal and tradable asset (or commodity) worldwide. It has vast liquidity,

trading and using more than billions of dollars in bitcoins a day. This exceeds the gross domestic product of

most sovereign countries. In fact, bitcoin is now worth more than Goldman's.

Nearly 20 million of them are in circulation. Bitcoin is just one of more than 10,000 cryptocurrencies for

people to buy, use and trade. According to incomplete statistics, at the beginning of 2013, there were only 2

million blockchain or encryption users worldwide. Since the beginning of 2017, the number of blockchain users of

various tokens has continued to exceed 20 million. In 2020, the global blockchain users exceeded 200 million,

and it is expected to exceed 1 billion users by 2025. At present, the total market value of global digital

assets has exceeded 1 trillion dollars, and the daily transaction size exceeds $100 billion, of which the

proportion of bitcoin transactions has decreased from 90% to 33%. This transaction data compared with the global

financial market daily transaction size of more than $5000 billion, the digital asset market has a large room

for development. In addition, according to incomplete statistics, the owners of global digital assets are about

20 million, and compared with the more than 1 billion stock users, the user scale of digital assets will also

have a huge space for development.

With the maturity of blockchain technology and the popularity of digital currencies, the digital economy has

also gained better support. Digital currency is the cornerstone of the development of the digital economy.

Developing digital economy and promoting digital development has become an irreversible trend, and digital

currency has gradually replaced paper currency with a solid technical foundation, and is more suitable for the

needs of the future development of digital economy. The main innovation point of blockchain is to solve the two

inherent problems of the traditional Internet, namely, the problem of "data island" and the problem of "data

right confirmation". At the same time, on-chain governance and smart contract are the innovation of the

governance form of blockchain itself. Digital currency is deeply reconstructing the social and economic value

system.

First, from control to autonomy. The distributed nature of blockchain will weaken authoritarian values such as

hierarchy, closure and control, and strengthen autonomous values such as equality, openness, collaboration and

sharing. Secondly, the incentive for new forms of production brought about by digital currencies will also

reinforce the shift in autonomy values. As Tapscott argues, blockchain will facilitate a shift from traditional

capitalism based on hierarchy and control to a new type of capitalism of "sharing, cooperation, crowdfunding and

self-organisation", where values such as creativity, democracy and participation will be strengthened.

Secondly, from efficiency to equity. The traditional Internet is cost-driven, and its fundamental goal is to

achieve economic benefits through information intermediation with maximum efficiency, while the blockchain will

make the fundamental goal of the Internet to protect transactions, create value and ensure fairness, legitimacy,

security and privacy of transactions, ultimately making integrity and fairness the core values. Finally, from

matter to relationship. When the Internet was first born, scholars predicted that information would replace

electricity and oil as the axial element of the social economy. Blockchain will further change the order of

value, with openness replacing channels, products, people and even intellectual property as the key to

organisational success, with "links" rather than "possessions" and "network relationships Links" rather than

"possessions" and "network relationships" rather than "closed structures" will become the source of value. Thus,

the digital economy based on blockchain and digital currencies has led to three windfalls.

The first windfall: Blockchain was born at the end of 2008 and has lasted 14 years. Countless miracles have

been created, led by Bitcoin.

The second windfall: it took place around 2015 and focused on the second generation of blockchain technology.

The scope of its application was enhanced by applying smart contracts to blockchain technology. A series of

public chains, represented by Ethereum, were born.

The third windfall: With the widespread popularity of the pass-through economy and commercial platforms, the

linking of real businesses is accelerating. Traditional business models and management thinking are no longer

applicable, and the formation of distributed business laws and the basic sense of the pass-through system has

pointed the way for enterprise chain reform.

Every change in technology is a new round of wealth restructuring. With the integration and development of

blockchain, digital currency and digital economy, the new thinking it brings creates higher business value, thus

solving many problems in the process of enterprise transformation and entrepreneurship. As a result, the real

economy (including the Internet industry) is applying blockchain technology in practice to improve the pain

points in its own operation. A large number of companies have already started to lay out around blockchain and

the digital economy, which will surely bring a new wave of wealth boom.

1.2 The fusion of blockchain and AI

In recent years, there have been many major breakthroughs that have been made in the field of artificial

intelligence (AI), and a global wave of research and application has been sparked. Artificial intelligence has

now penetrated into every gap in human society, and will become an important cornerstone to promote the change

of human society. The huge data proves that the future market prospect of AI is promising. As the core driving

force of the new round of industrial transformation and a strategic technology leading the future development,

governments of all countries attach great importance to the development of artificial intelligence industry.

At the same time of the breakthrough in the technology and application of artificial intelligence industry, the

field of artificial intelligence has won the favor of capital, become the tuyere industry, and entered a period

of rapid progress with the coordinated support of capital and technology. The level of artificial intelligence

is based on machine learning. In addition to advanced algorithms and hardware computing capabilities, big data

is the key to machine learning. Big data can help to train machines and improve their intelligence level. The

richer and complete the data, the higher the more accurate the machine identification, so big data will be the

real capital for enterprises to compete. We believe that big data is the nourishment for the progress of

artificial intelligence, and is an important foundation for the construction of artificial intelligence

building. By learning a large amounts of data, the machine judgment processing ability continues to rise, and

the intelligence level will continue to improve.

Since the emergence of artificial intelligence, it has received wide attention and strong support from various

industries. It greatly facilitates the life and study of human beings, and brings new possibilities for the

development of science and technology. But while AI technology continues to improve people's quality of life and

promote scientific research, it also poses troubling problems. Such as: data monopoly, limited computing power,

lack of algorithms, technology abuse, privacy leakage, etc. The emergence of blockchain technology brings new

opportunities to the solution of the existing problems in artificial intelligence. With the continuous in-depth

research of blockchain technology, researchers took advantage of the advantages of blockchain technology to

improve the difficulties in the development of artificial intelligence technology and achieved good results.

1)Blockchain can facilitate data sharing

Data is the core driver of AI development and the fuel of AI. Data is shared by everyone in order to have richer

data to offer, data can only create greater value if it flows more efficiently, data can only be owned by real

providers in order to protect data ownership and incentivise people to provide it, while ensuring that it is

reliable and authentic, and only data power is more easily exchanged in order to enhance efficiency. And all of

this requires a fair, incentive-based mechanism to achieve. The blockchain itself has a depository, unmodifiable

and economic incentive mechanism to provide a good solution.

2)Blockchain and identity and security

Blockchain will enhance the security mechanisms of AI: it will help AI to achieve contract management and

improve the user-friendliness of AI. For example, allowing users of the device to register on the blockchain,

enabling different levels of user access through smart contracts, and providing personalised features for

different levels of users. Blockchain ensures that devices can be accessed in a hierarchical manner through user

registration, which not only prevents misuse of the device, but also prevents users from being harmed. Common

ownership and common access to devices can be better achieved through blockchain, which will allow users to

jointly set the state of the device and make decisions based on smart contracts.

3)Blockchain and AI value exchange

The blockchain itself has the characteristics of openness, fairness and transparency, and the transactions in

the blockchain are more transparent, so building a more transparent transaction market based on the blockchain

will be more fair, and at the same time, due to the characteristics of universal participation, a broader

platform will be built, which is conducive to the reciprocal exchange of value. the exchange of AI, data and the

embodiment of value are more easily realized in the blockchain world, eliminating the information asymmetry and

barriers to transactions. This eliminates information asymmetries and barriers to transactions, as is now the

case with Bitcoin, for example. This will undoubtedly facilitate the accelerated flow of AI and data, and will

facilitate more people to participate in the provision of AI and data. Blockchain transactions make extensive

use of smart contracts, which are essentially an automatically executing machine, a kind of machinization and

automation of transactions. This mechanism is ideal for transactions in AI-related products, such as data

provided to algorithms or models, where the results of different AI calculations are similarly datamined and the

exchange process is automatically executed through smart contracts, accelerating and optimising the transaction

process and making it more conducive to AI At the same time, the blockchain itself has the incentive mechanism,

through TOKEN and so on it is easy to achieve the value of the metric.

4)Computing power sharing and assistance

The current Bitcoin network or Ethernet network is undoubtedly a huge pool of computing power. Machine learning,

especially deep learning algorithms, requires a large amount of computing overhead, while deep learning and

neural network algorithms themselves require multi-node computing collaboration, the blockchain itself is a

distributed computing resource, while the decentralization and incentive mechanism of the blockchain can better

manage and share computing resources, not only The decentralization and incentive mechanism of blockchain can

better manage and share computing resources, not only using the computing resources in data centres, but also

collaborating and sharing the idle and scattered computing resources to build a larger and more convenient pool

of computing resources for transactions.

With the development of 5G and IOT, discrete computing resources such as edge computing and fog computing need a

broader and more trusted management network. Blockchain provides a shared, transparent and transactable

computing environment that can organise these resources. Therefore building a decentralized resource pool with

blockchain, while achieving trustworthy and value-based management, can better utilize various computing

resources, whether they are cloud computing resources or discrete computing resources.

5)Blockchain provides a safe and reliable development environment for AI

Blockchain's smart contract and smart transaction mechanism can well play the functions of privacy protection

and data opening and data fusion, and can make the data transaction information subject in an encrypted state.

At the same time, due to the non-tamperability of blockchain records, it can also facilitate people's enquiry

and supervision of AI device records, and enhance people's trust and acceptance of AI. In the era of data

supremacy, people can extract a lot of valuable information from data. Blockchain and technology can both secure

the data and assist in extracting valuable information. Blockchain can therefore play a crucial role in

improving the information leakage problem that exists with artificial intelligence.

In the crypto space, the integration of blockchain technology with AI technology then provides the technical and

algorithmic support for quantitative trading.

1.3 The rise of quantitative trading

In the context of the digital age, with the extensive application of big data, artificial intelligence, cloud

computing and blockchain technologies, the so-called "quantitative revolution" has also appeared in the

financial market. Quantitative and program trading has become more and more popular trading mode in financial

institutions. In the past half century, many mathematicians have tried to intelligently and automate investment

business, and quantitative methods as early as the 1950s. Due to the lack of powerful database resources and

computer tools, many ideas have not been applied. But it improved dramatically after the Internet revolution in

the 1980s and the data explosion in the 1990s. Hedge fund managers, represented by Simmons, seized the

opportunity of this digital technology revolution and launched a "quantitative revolution". The rapid

development of digital resources, artificial intelligence and algorithm technology has brought about the

knowledge revolution and the continuous improvement of investment methods, and further led to the explosion of

data volume. In addition, with the nature of capital seeking profit, the scale of quantitative investment

continues to expand.

Against the backdrop of the COVID-19 pandemic, various contradictions and problems accumulated in the global

economy and finance in the past decade have become increasingly obvious, the real industry, residents'

confidence, social governance and other fields have been under all-round shocks, the international financial

market has been volatile, and various black swan events have emerged in an endless stream. In the future, the

global economy is likely to continue to fall into recession, and at the worst, it could even enter a prolonged

depression. Bitcoin and its underlying blockchain technology, created in the wake of the global financial

crisis, have already triggered a wave of innovation that has changed the way assets maintain and increase value.

At present, the market generally believes that the market share of the mainstream digital currency has been to

seize the market, and the derivative field based on digital currency is also skyrocketing. Digital currency

quantitative financial management market

——, a trillion-level huge blue ocean market is rising!

1)outsider

Ordinary investors often fall prey to market volatility because they have no investment tools. Every retail

investor, in the face of returns and risks, may make investment decisions isolated and stranded in greed and

fear. And every company that receives crypto asset financing, after the bull and bear rotation, will be glad or

painfully realize that crypto asset management is related to the company's financial situation and even

survival.

2)Quantitative investors

Most crypto asset investors, when facing the 7×24 crypto asset market with professional investment teams, prefer

to entrust professional quantitative investment institutions to make quantitative investments with their own

funds due to the lack of investment capabilities and quantitative investment tools of professional investment

institutions. With the leap forward in financial big data technology, quantitative investment funds, which

leverage modern statistics and computer science methods to find high probability winning opportunities from

massive amounts of data, have shown unique advantages in the volatile market. Take Bitcoin for example, Bitcoin

trading has the following characteristics that make quantitative trading a great fit with Bitcoin trading

No stop limit; 24*365 non-stop trading; extremely low threshold, 10 or 20 bucks is fine, users can apply for

the exchange API.

No limit on the number of transactions, no commission on spot.

A booming market, with active futures and spot markets.

There are many bitcoin trading platforms, which have more arbitrage operation opportunities for quantitative

investment.

Bitcoin is only one of thousands of digital currencies. With the prosperity of the digital currency market, more

people are exposed to more high-value currencies, and the era of intelligent quantitative trading is close at

hand.

1.4 Smart trading —— quantitative strategy

1)Quantitative Trading Strategies

Quantitative trading refers to the process of replacing human subjective judgement with advanced mathematical

models, using computer technology to select from a large amount of historical data a variety of "probable"

events that can bring excess returns in order to develop strategies, and using certain mathematical models to

implement investment concepts and achieve investment decisions. In this process, it is important to reduce

subjective factors, reduce the impact of investor sentiment and avoid making irrational investment decisions in

the event of extreme market frenzy or pessimism. The main features of quantitative trading are as follows.

Broad investment perspective: With the efficient and accurate processing of starfish information by computer,

go for a wider range of investment opportunities in all markets.

Discipline: Strict discipline is an important feature that clearly distinguishes quantitative trading from

active investing. Investment decisions made by quantitative trading models are strictly enforced, rather than

modified at will as trader sentiment changes. The benefits of discipline are many and can overcome human

weaknesses such as fear, greed and fluke, as well as cognitive biases.

Systematic: The systematic nature of quantitative trading mainly includes multi-level quantitative models,

multi-perspective observation and observation of massive amounts of data. Multi-level models mainly include

sector selection models, broad asset class allocation models and selected individual stock models, etc.

Multi-angle observation mainly includes analysis of macro cycles, valuations, growth, earnings quality, market

structure, analysts' earnings forecasts and market sentiment from multiple perspectives.

Timeliness: Timely and rapid tracking of market changes, constantly identifying new statistical models that can

provide huge returns and going for new trading opportunities.

Arbitrage thinking: quantitative investing captures opportunities arising from mispricing and misvaluation

through comprehensive and systematic scanning, thereby identifying valuation pockets and profiting from buying

undervalued assets and selling overvalued ones.

Probability to win: Firstly, quantitative investment constantly mines historical data for patterns that are

expected to repeat and exploits them; secondly, it relies on a portfolio of assets to win, rather than

individual assets to win.

2)Grid trading strategy

Grid quantitative is a high frequency programmed automatic trading, is one of the many quantitative trading

strategies. Dow Theory states that price movements in financial markets can be divided into three situations,

namely up, down and bull. And in the process of rising or falling there are also continuous fluctuations on

shorter cycles, with prices eventually presenting themselves either as trendless fluctuations or as short-term

fluctuations and long-term trends. In the foreign exchange market there is a trading concept known as grid

trading method, this concept believes that in a certain time period, the price is basically in a state of

reciprocal fluctuations, investors can trade with a higher frequency and use limit orders to gain the benefits

of price fluctuations.

The grid trading method, applicable to oscillating markets, is to buy low and sell high. This is done by

dividing the capital into n shares, with a single trade of a fixed amount, initially opening a position and then

setting a percentage or spread to determine the width of the grid, for example 5%, buying one share if the price

of the currency falls by 5%, selling one share if it rises by 5%, and so on. The above grid trading strategy

requires the use of analysts to set parameters without the use of historical data. The analyst sets the upper

grid edge, lower grid edge, grid pivot, grid width and single trade size, and then automatically executes the

grid plan to buy low and sell high repeatedly for profit. In some special cases, the process of setting up a

grid trading strategy supports unequal splitting of funds, such as increasing the single trade amount by a

certain percentage, e.g. 10%, for every grid down, thus extending into a Martin strategy.

3)Arbitrage Strategies

Move arbitrage: Move arbitrage is also one of the most used strategies in quantitative trading platforms. It is

a low-risk arbitrage with very low arbitrage risk itself. The software captures the spread between different

trading platforms for the same currency, buying on the platform with a low price and selling on the platform

with a high price to earn the difference.

Spot and Cross-Period Arbitrage: Spreads will exist between the spot and futures of an underlying trade on the

same trading platform and between the current week, next week and quarterly contracts for that underlying. Cash

and futures arbitrage is the use of the spread between spot and futures to make a reverse operation in futures

and spot to earn the difference. Similarly, cross-period arbitrage is the use of the spread between different

contracts to make a reverse operation in the contract to earn the difference.

Statistical arbitrage (cross-currency arbitrage): is an arbitrage that takes advantage of the historical

statistical pattern of asset prices and is a risk arbitrage where the risk is whether this historical

statistical pattern will continue to exist for some time to come. The main idea of statistical arbitrage is to

first identify a number of pairs of investments with the best correlation, for example, BTC and ETH have a

strong positive correlation. When the price difference between BTC and ETH deviates to a certain level, you

start to open a position, buy the relatively undervalued variety and sell short the relatively overvalued

variety, and then take profits when the price difference returns to equilibrium.

1.5 DGA Birth

Currently, intelligent custodian trading and quantitative arbitrage trading are generally tested by means of

massive data simulation tests and simulated operations, and positions and capital allocations are made based on

certain risk management algorithms to minimise risk and maximise returns, but there are often certain potential

risks, including.

Completeness of historical data. Incomplete market data may lead to a mismatch between the model and the market

data. Style shifts in the market data itself may also lead to model failure, such as trading liquidity, price

volatility, and frequency of price fluctuations, which are currently difficult to overcome in quantitative

trading.

Models are not designed with position and capital allocation in mind and without safe risk assessment and

precautions, which may lead to a mismatch of capital, position and model and a blow out.

Network outages and hardware failures may also have an impact on quantitative trading.

Risks arising from homogeneous models generating competing trades.

The risk of unpredictability due to a single investment vehicle.

Based on this, DGA aspires to solve the pain points of the industry through the application of multi-strategy

combinations and intelligent algorithms, distributed storage, and edge computing, and create a new value-earning

space for intelligent custodian trading, arbitrage trading and investment bands for digital currencies.

At present, intelligent custodian trading and quantitative trading, as the main form of digital currency

intelligent finance, is being accepted by more and more users/investors, with a broad market prospect. DGA has

pre-empted the layout and created the DGA cryptocurrency AI quantitative investment platform, with a view to

creating higher value returns for global users in this blue ocean market, so that every Every participant can

hold and gain from their cryptocurrency holdings.

Chapter 2 DGA Project Overview

2.1 DGA Company Profile

DGA was founded in 2017 in London, UK, under the name Digital Genius Alliance, and is dedicated to global

blockchain technology development, innovation, cryptocurrency trading services, asset custody, and network

security and operations. DGA has won numerous awards from the Global Blockchain Consortium for innovation in

technology, and has achieved a level of success that few companies in the blockchain space have achieved.

Since its inception, DGA has continued to increase its share of the global cryptocurrency investment market,

setting new all-time bests and creating one business miracle after another. With a global user base of over 1

million and an average daily peak of 300,000 active users, DGA has become a well-known global blockchain company

that has not only contributed to the rapid development of the global blockchain sector, but has also become a

pioneer of the innovative revolution in the global blockchain sector.

"Let technology shine the light of life" is not only the slogan of DGA, but also the mission of DGA. We are

committed to building an intelligent cryptocurrency custodian trading system with "DGA's characteristics" and

are dedicated to improving the efficiency and accuracy of cryptocurrency trading for every user. We are

dedicated to improving the efficiency and accuracy of cryptocurrency trading for every user, eliminating the

tedious process of manual trading and maximising returns scientifically.

After six years of solid development and growth, DGA has now become a well-known company in the global

blockchain sector, showing strong competitiveness in the industry, continuing to set new all-time highs in

market share and increasing its overall strength, DGA has become a leader in the field. The many notable

achievements are the result of the hard work and dedication of all members of the team, which has made DGA a

business miracle day in and day out. Now and in the future, DGA will continue to work together with its members

to pursue higher chievements and glory.

With the rapid development trend of global blockchain, in the near future, the wave of intelligent trading mode

of cryptocurrency will definitely sweep the global cryptocurrency investment market and become the first choice

of cryptocurrency investment enthusiasts around the world, and DGA's intelligent custodian trading system will

also become the vane leading the global blockchain field.

2.2 Business category

DGA is based in London, UK, with operations in the UK and the entire European market. With the mature use of 4G

technology and the advent of 5G technology, it has accelerated the promotion and coverage of the blockchain

technology and cryptocurrency investment wave worldwide. DGA is now available in the UK and Europe, as well as

in Asia, South America, North America, and the Middle East, among other major economies.

DGA will provide cryptocurrency investors around the world with the most scientifically sound and intelligent

way to manage their money, as well as professional and secure digital asset trading and management services, to

enhance the cryptocurrency investor's connection to the cryptocurrency market and trading efficiency through the

power of science and intelligence.

DGA is one of the first companies to research digital currency quantitative trading, and is far ahead in the

field of digital currency quantitative, trading. Dedicated to making it possible for the general public will

have access to the financial value embedded in their financial assets, users of financial services will have

access to services at a lower cost, and the entire financial system will be run much more efficiently and at a

much lower cost.

The digital currency business systems that DGA has participated in or developed in-house have served over 10

million users in many countries around the world. DGA's digital currency storage and exchange projects enable

the unified management of multiple blockchain assets, one-stop management, decentralised services, multiple

security guarantees and multi-language support functions.

DGA's business also includes innovative businesses such as cloud services, digital media, and its cryptocurrency

derivative industry. In addition, it also aims to create digital payment services and digital financial services

for investors and cryptocurrency merchants. At the same time, DGA strives to become a global cryptocurrency

investment market with 10 million users, and to build a DGA-specific industry ecosystem that seamlessly

integrates investors, digital exchanges, and strategic partners around DGA and market characteristics.

2.3 Intelligent custody and trading system

With the high growth rate of cryptocurrency investment, it continues to refresh its share share of trading in

global financial investment products, creating a substantial exchange rate space in the huge daily trading

volume worldwide. However, the existence of numerous cryptocurrency trading institutions around the world and

the tedious process of manual trading does not accurately capture the ever-changing nature of the market. As a

result, the traditional manual trading model is not only time consuming and labor intensive, but also does not

ensure the desired trading returns and even faces losses when the exchange rate price encounters significant

fluctuations.

In this environment, the DGA intelligent custodian trading system was born. The birth of this trading model not

only marks the advent of the global cryptocurrency intelligent trading model, but also accelerates the wave of

the global mobile digital economy.

The advantages of the DGA Intelligent Custodian Trading System are clear.

As a pioneer in the global cryptocurrency investment market, DGA has not only a mature blockchain technology

team, but also a financial investment and asset management team with rich practical experience, providing the

best quality of stable asset appreciation services 24 hours a day, so that every asset can be operated under the

scientific and intelligent trading system to achieve the maximum return. Maximisation.

The scientific and intelligent trading model not only eliminates many tedious trading processes, but also

captures the real-time quotes of major trading institutions and captures the best time to trade at each time

through the system's intelligent screening, ensuring that each trade can be bought when the exchange rate is

relatively low and sold when the exchange rate is relatively high, making it easy to trade profitably.

Users can easily earn the corresponding percentage of commission by simply activating the intelligent trading

button each day, eliminating the need to waste time waiting for the right time to trade and comparing prices

with various trading institutions, making it easier to grow your wealth.

DGA's intelligent trading system combines the amount of money invested by each user, the fluctuation of the

market during each trading period, the exchange rate of each trading institution, and the price of each

cryptocurrency. DGA's intelligent trading system combines the capital invested by each user, the fluctuation of

the market in each trading period and the exchange rate of each trading institution to develop the best trading

strategy after scientific screening and calculations. At the same time, DGA's funds are subject to strict

supervision by the funds regulators of each regional market to ensure the safety and security of each fund,

allowing users to choose DGA

with greater confidence and boldness.

DGA's solid business model also provides additional protection for its customers by forming a "win-win"

partnership with them.

DGA's intelligent custodian trading system provides users with a steady increase in asset value, but only shares

50% of the proceeds from each transaction, with the remaining 50% going to the user. In order to ensure that

each user achieves stable wealth appreciation, DGA will cover 100% of the amount of losses caused by extreme

fluctuations in market conditions due to major issues such as war, politics and disasters, in order to build a

reputation as the most trustworthy and honest company.

In addition, DGA is not just a single trading model of buying low and selling high, DGA will also provide users

with more professional skills training and various official activities to enhance the practice and active

participation of users, not only to help users earn more extra wealth, but also to gain more fun and

achievements. It is a way for every user to appreciate the power of scientific asset management, to help every

user remain competitive in a fast moving society, to make assets gain faster than they depreciate, and to show

the value of assets far beyond the assets themselves.

Since its inception, DGA has always taken into account the characteristics of the market and constantly upgraded

its intelligent trading system, only to create the most scientific and intelligent trading system, helping

cryptocurrency investment enthusiasts to easily achieve a seamless trading environment with the major global

trading institutions.DGA's unique intelligent custodian trading system and zero-risk capital security guarantee

DGA has become the most trustworthy asset custody trading service platform for users and, with continuous

development, DGA is bound to occupy an absolute dominant position in the entire cryptocurrency investment

market.

DGA is not only a stable way to add value, but also a safe and secure way to protect today's digital asset

trends, and to ensure that every user's capital can be steadily added to and secured.

2.4 Future development

With the global popularity and promotion of blockchain technology, cryptocurrency has rapidly become the hottest

financial investment product since its birth, and has been closely watched by global investment users, and has

continuously broken through the market share of major financial investment products worldwide, becoming the

first choice of the global financial investment crowd.

The rapid development of the global cryptocurrency investment market has created a golden period of development

for global blockchain technology that is unavailable. According to the analysis of the market data of the past

three years by researchers of well-known financial investment institutions, the world blockchain market will

continue to maintain a high growth rate in the next five years, and the market scale growth rate will continue

to be as high as 50% from 2023 to 2028, and the market scale will reach trillions of dollars in 2028, and the

world blockchain industry market scale is expected to exceed trillions of dollars in the next 20 years.

In order to enhance the comprehensive competitiveness of the enterprise and achieve sustainable development, DGA

has been continuously recruiting outstanding talents since its establishment to inject more talent reserves for

the sustainable development of the enterprise. DGA also actively cooperates and exchanges with companies in the

same field to learn and share their experiences and research results, contributing to the stable and healthy

development of global cryptocurrency investment market.

In addition, DGA is also actively involved in global charitable causes. Up to now, DGA has helped tens of

thousands of people in disasters, and in the future, DGA will help more people in need, helping more people to

get out of trouble and confusion and create a better future together.

DGA's remarkable achievements have been made possible by the unwavering support and contribution of each and

every one of its users, and it is the hope of DGA that through its own efforts, the world will be filled with

more love and that more people will join the Love DGA is committed to making the world a better place.

In the future, DGA will be with each and every one of its users, pioneering innovation and sharing the joy

together to create a greater business blueprint.

DGA, let the light of technology - light up life.

DGA-GPT

DGA-GPT is a trading system that integrates artificial intelligence technology, and conducts one-stop

intelligent trading activities through the computer's automated trading program. DGA-GPT can automatically

identify market trends, analyze price curves, formulate trading strategies and trade accordingly, and can obtain

higher advantages than manual in terms of time, speed, and decision-making quality.

1. What is one-stop intelligent trading?

One-stop intelligent investment: You don't need to understand the macro cycle, market structure, valuation,

growth, profit quality, market sentiment, etc. of cryptocurrencies, and analyze and count data, etc. AI

artificial intelligence will automatically invest based on numbers, statistics, and computer technology to

obtain continuous, stable and above-average returns.

2. Why choose DGA-GPT decentralized intelligent trading platform?

The price of cryptocurrencies has been in a state of fluctuation, so experienced cryptocurrency traders rely on

cryptocurrency market charts to make trading decisions. However, when cryptocurrency prices fluctuate violently,

it can be difficult to keep up, resulting in missed opportunities and sometimes market FOMO. For traders who

trade in multiple crypto assets and multiple cryptocurrency exchanges, things become very complicated, and

continuous monitoring becomes a difficult task.

DGA-GPT automatically collects data changes from various platforms 24/7. Based on the fact that asset prices

fluctuate within a certain range, it can place orders intelligently at different points within the range, buy

low and sell high, and automatically complete crypto transactions, so that investors can profit from price

fluctuations.

DGA-GPT has the following features:

1. Automated trading: The intelligent trading system can automatically identify market trends and conduct

trading activities.

2. Data analysis capabilities: Through big data analysis capabilities, DGA-GPT can more accurately quantify

market risks and opportunities and improve the accuracy of investment decisions.

3. Artificial intelligence technology: DGA-GPT's trading strategies are based on a variety of different machine

learning algorithms, including neural networks, genetic algorithms, support vector machines, etc.

4. Real-time monitoring: DGA-GPT can monitor market conditions in real time and modify trading strategies to

adapt to changes.

2. DGA-GPT4 is not affected by human emotions

2. DGA-GPT4 is not affected by human emotions

4. DGA-GPT4’s strict discipline

4. DGA-GPT4’s strict discipline

6. DGA-GPT4 Automates Trading Diversification

6. DGA-GPT4 Automates Trading Diversification

Compared with manually managing transactions, DGA-GPT4 intelligently and quickly handles a wider range of

portfolios at a lower cost. It can change as the market changes to maximize profitability.

DGA-GPT4 has now undergone its fourth transformation to expand its functions and simplify investors'

transactions. It only takes one click to click the intelligent transaction and wait for 2-3 minutes to achieve

profitability. It is undoubtedly the future of investors.

Compared with manually managing transactions, DGA-GPT4 intelligently and quickly handles a wider range of

portfolios at a lower cost. It can change as the market changes to maximize profitability.

DGA-GPT4 has now undergone its fourth transformation to expand its functions and simplify investors'

transactions. It only takes one click to click the intelligent transaction and wait for 2-3 minutes to achieve

profitability. It is undoubtedly the future of investors.